VR adoption is accelerating thanks to the Oculus Quest. We’ve seen over 100 VR titles break $1 million in revenue, growing the total VR software market by 3x in 2019. Top grossing VR titles have cleared $10 million in revenue, and can reach up to $60 million in sales given the current distribution of headsets in the market so far. Though still small, VR is a growing and sustainable platform for developers.

Guest Article by Tipatat Chennavasin

Tipatat is a General Partner of the Venture Reality Fund investing in early stage VR, AR, and AI companies. He has looked at over 5,000 companies in the space and has invested in 35, including the makers of hit VR games like Beat Saber, Rec Room, and Job Simulator.

It’s difficult to get real data on the VR consumer market. People tend to focus on headsets sales, which remains largely speculative as only Sony ever publicly discloses numbers. Even so, a far more important data point we do have is software sales—this is a key metric for differentiating between a platform and a product. Because even if Oculus sold 100 million VR headsets, but no third-party developer could make $1 million in revenue, then it wouldn’t be a platform; it would be a successful product for Oculus, but it wouldn’t be a viable platform to create an ecosystem of successful developers.

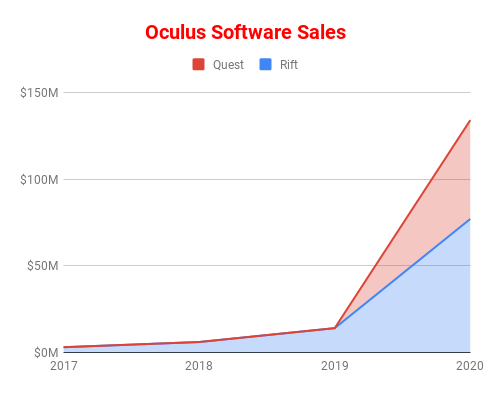

Oculus proved that VR was more than a product when they officially released numbers about their ecosystem last September at Oculus Connect 6. During the convention, they announced that VR software sales on their platform had exceeded $100 million; $20 million of that just from the Oculus Quest ecosystem, which launched only four months prior. But that’s not the only signal we have that VR is a growing and sustainable platform.

Tracking VR Software Sales

We see a strong correlation between the number of reviews of a given app and the number of sales it has. Because all the VR app stores allow us to see the number of reviews, we’re able to track the ‘health’ of the ecosystem by looking at the number of reviews over time.

This analysis covers reviews-over-time for all major VR app stores: Oculus Rift, Oculus Quest, Steam, and PSN. It’s also thanks to sales data generously shared with the author from various VR game studios that we’re able to create a reliable analysis of where VR is now, and how far it’s come.

Oculus

From our estimates, there is relatively small software sales for the first couple of years, and then a major inflection point in 2019. That spike represents an almost 10x jump in software sales from the previous year! We believe this is thanks to the introduction of new hardware—Oculus Quest and Oculus Rift S—as well as the launch of several exclusive hit games like Asgard’s Wrath and the continued success of Beat Saber. Four months after launch, Quest accounted for 20% of Oculus software sales; seven months after launch, Quest is now nearly 40%.

From our estimates, there is relatively small software sales for the first couple of years, and then a major inflection point in 2019. That spike represents an almost 10x jump in software sales from the previous year! We believe this is thanks to the introduction of new hardware—Oculus Quest and Oculus Rift S—as well as the launch of several exclusive hit games like Asgard’s Wrath and the continued success of Beat Saber. Four months after launch, Quest accounted for 20% of Oculus software sales; seven months after launch, Quest is now nearly 40%.

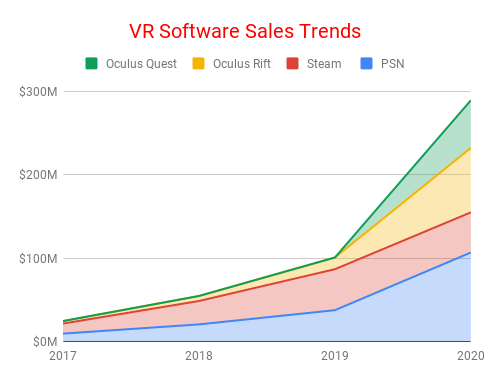

All Major VR Storefronts

Based on our estimates, we see 2019 as a major inflection point for the entire market, almost tripling yearly revenue to nearly $300 million across all platforms. This is mostly driven by the success of Oculus but also a significant uplift in the PSVR marketplace mainly driven by the success of Beat Saber and other new hit VR games.

Based on our estimates, we see 2019 as a major inflection point for the entire market, almost tripling yearly revenue to nearly $300 million across all platforms. This is mostly driven by the success of Oculus but also a significant uplift in the PSVR marketplace mainly driven by the success of Beat Saber and other new hit VR games.

What makes Oculus interesting is how much it has grown the market in the past year, if you look purely at software revenue. Sony announced sales of PlayStation VR in January 2020: 5 million headsets over the last four years. Our estimates suggest nearly $110 million in software revenue recorded in 2019. Oculus hasn’t announced how many Quests are out there, but given that it’s probably a much smaller install base, it’s impressive to see it drive nearly $60 million in software revenue for 2019.

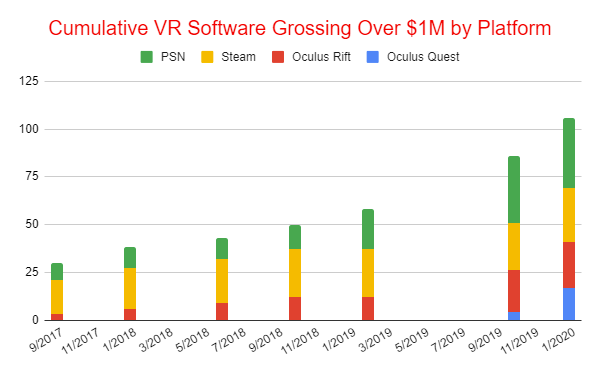

What it Means for Developers

For a nascent platform, it’s an important milestone when a software title can earn $1 million in revenue. Here, we chart over time how many titles hit that $1 million mark across each platform. Platforms that have multiple titles breaking $1 million can be called ‘healthy’ because it implies that success is repeatable and there’s room for more developers.

Based on the data we’ve collected, by the end of 2017 we estimate that almost 40 titles made over $1 million in revenue. And in 2017, a top VR title grossed $10 million. By the end of 2018, that grew to 60 titles at the $1 million milestone, and top titles grossed over $20 million. Now at the end of 2019, we’re at more than 100 titles exceeding $1 million in revenue, and at least one top title grossing over $40 million in annual revenue.

Based on the data we’ve collected, by the end of 2017 we estimate that almost 40 titles made over $1 million in revenue. And in 2017, a top VR title grossed $10 million. By the end of 2018, that grew to 60 titles at the $1 million milestone, and top titles grossed over $20 million. Now at the end of 2019, we’re at more than 100 titles exceeding $1 million in revenue, and at least one top title grossing over $40 million in annual revenue.

The majority of these titles were not made by large AAA studios, but by small indie studios. To our knowledge, several of these studios received no independent financing from either investors or platforms; they were entirely self-published and self-made successes. Beat Games, makers of Beat Saber, earned over $20 million in their first year and became the first VR game to sell over 1 million copies. Compare this to Angry Birds, the mobile game most people see as the first major success to validate the mobile gaming market, which made $7.15 million in its first year.

We believe the success of indies in VR is a sign of a genuine platform. It also means established leaders from previous platforms like mobile or PC gaming don’t have an unfair advantage as incumbents; the perception of VR as ‘anyone’s game’ draws more developers into the ecosystem, which has the potential to generate more revenue as Oculus and others continue to push distribution of VR headsets to consumers. It also helps that indie titles have smaller initial development budgets and don’t need to spend much (if any) on marketing; this helps them achieve profit more quickly when they start getting popular on the strength of organic discovery or platform-led marketing offered by Oculus, PlayStation, and others.

Which Games Are Succeeding and Why

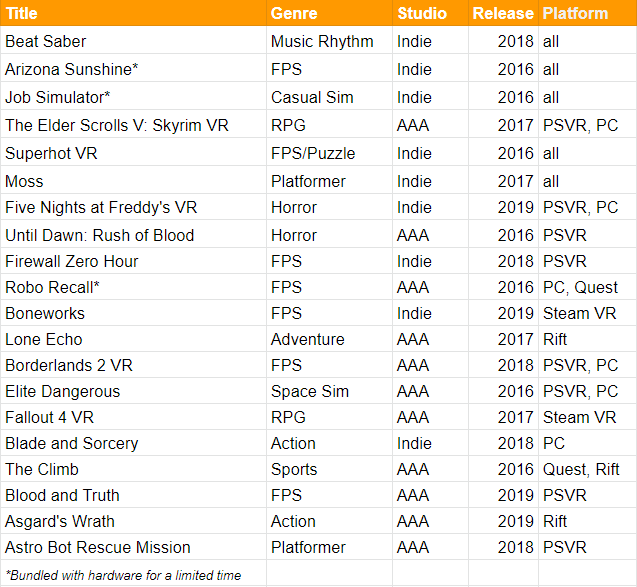

Now let’s look at what games are selling. Based on the data we’ve collected, these are the top 20 grossing VR games across all the platforms, all at over $4 million in revenue, with the top seven clearing $10 million:

Look at a common factor in the winners: natively-built VR titles clearly lead PC ports and IP-driven launches even when they’re as well known as Fallout or Skyrim. Of course there are plenty of shooters and a couple ports, but like on new platforms, the games that are built native for the platform succeed the most. Games are about interactivity, dictated by input and for VR, that input is the 1:1 motion controls that allow for complex gesture based interaction. The first platinum-selling VR games Beat Saber and Job Simulator are perfect examples of this. Even the top performing shooters in VR embrace VR-specific gameplay like rich object interaction in Robo Recall or Boneworks.

Look at a common factor in the winners: natively-built VR titles clearly lead PC ports and IP-driven launches even when they’re as well known as Fallout or Skyrim. Of course there are plenty of shooters and a couple ports, but like on new platforms, the games that are built native for the platform succeed the most. Games are about interactivity, dictated by input and for VR, that input is the 1:1 motion controls that allow for complex gesture based interaction. The first platinum-selling VR games Beat Saber and Job Simulator are perfect examples of this. Even the top performing shooters in VR embrace VR-specific gameplay like rich object interaction in Robo Recall or Boneworks.

The top seven grossing games are cross-platform, which shows how important it is for developers to think about a cross-platform approach to maximise their potential audience, but none of the games did simultaneous launches across all the platforms. In the top 20, there are quite a few exclusives which suggests that each platform has a big enough consumer base to support hit games and, much like on console, exclusive games are important for the ecosystem.

Encouragingly there is a good spread of games from each year, showing that VR games can be evergreen, but also that new games being released are finding success This shows a healthy ecosystem and that new franchises and IPs are being established and can compete with established brands and IP in this new market.

Interestingly, the top games are being developed all over the world. Beat Saber from the Czech Republic, Arizona Sunshine from the UK, Job Simulator from Austin, Texas, Super Hot from Poland, Moss from Seattle, Washington. It’s great to see that success can come from anywhere and anyone.

– – — – –

When looking for a new platform, it’s important to note when the first third-party developer makes $1 million. Three and a half years into consumer VR, there are other 100 titles that have made over $1 million, and amazingly, a top VR title can gross over $60 million in two years with no signs of slowing down. And this is with an estimated install base of 10 million units that is now growing at an accelerated pace. It’s exciting to see the beginnings of a new platform and seeing indies and startups succeed anew. At this pace, we should easily see the first VR title reach the $100 million milestone by this time next year and that will show when VR graduates from an emerging platform to one that everyone should pay attention too.

Update (February 24th, 2020): Updated the ‘Cumulative VR Software Grossing Over $1M’ chart with a new axis which more accurately represents the data timeline.